Why Focus on Risk Management?

Managing risk is a shield against your potential losses. Risk management in Forex trading is crucial for several reasons. Firstly, it safeguards your trading capital, preventing significant and unrecoverable losses. It also helps maintain consistency by setting predetermined risk levels for each trade, ensuring that no single trade can jeopardize your entire account.

Moreover, effective risk management fosters discipline, reducing emotional decision-making and promoting a strategic approach to trading. By skillfully managing risk, traders can increase the probability of long-term success in the dynamic Forex market.

Lot Size and Risk Management

Selecting the appropriate lot size in Forex trading is crucial for implementing effective risk management. The lot size determines your trade volume, influencing potential profits and losses. Optimal lot sizing ensures that you risk a suitable percentage of your trading capital in each position, preventing excessive losses in the face of market fluctuations. It is a critical tool for maintaining a balanced and sustainable trading strategy, helping traders navigate the unpredictable nature of the Forex market while safeguarding their investment!

Understanding the Basics

Here are the basics you need to understand before calculating the right lot size for your trade:

Lot Size

In Forex trading, lot size refers to the standardized volume of a trade. The standard lot size is 100,000 units of the base currency, with variations such as mini lots (10,000 units), micro lots (1,000 units), and nano lots (100 units), that determine the volume and risk exposure in a trade. Note that not many brokers offer nano lots.

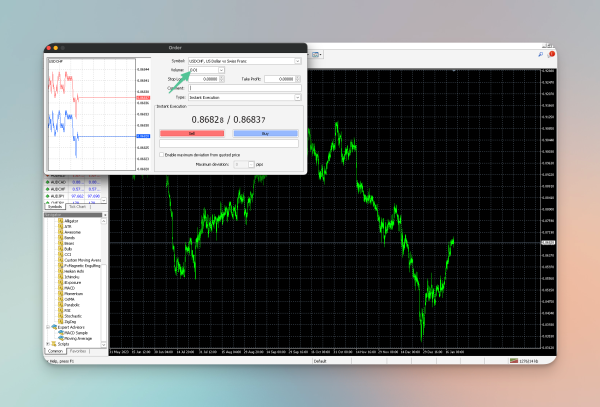

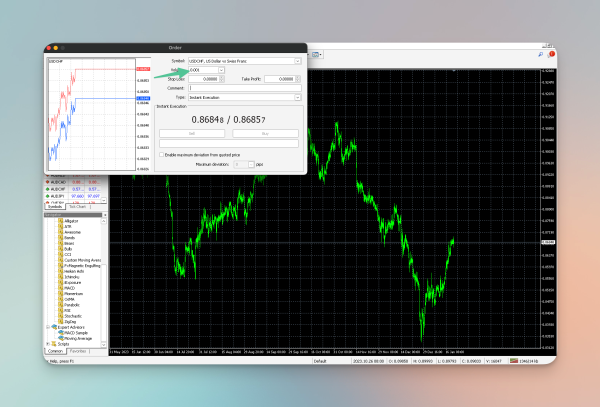

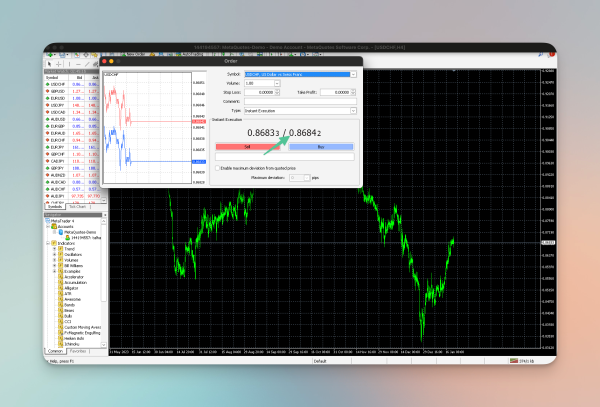

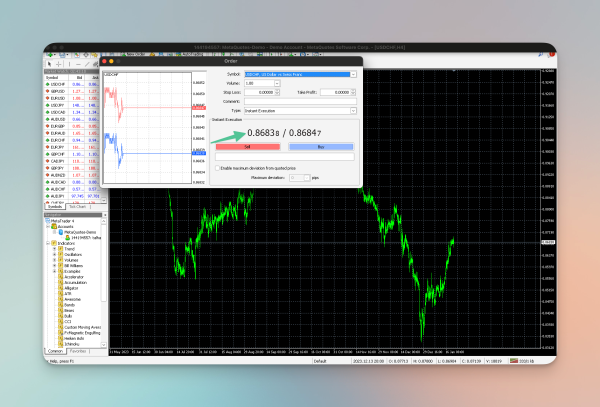

You can determine the Lot size and volume from the “New Trade” menu when placing a trade order in MetaTrader 4. In your MetaTrader 4 application:

-

Click on “New Trade” in the top menu.

-

Next, select the desired lot size for your order, e.g:

a. For a Standard Lot, set the volume as 1:

-

For a Mini Lot, set the volume as 0.1:

-

For a Micro Lot, set the volume as 0.01:

-

For a Nano Lot, set the volume as 0.001:

Risk Management

Risk management in Forex trading involves implementing strategies to minimize potential losses. Risking only a small percentage, like 1%, safeguards your account from significant losses. It’s the cornerstone of successful trading.

Stop Loss

In Forex trading, stop loss is a predetermined price level at which a trader’s open position is automatically closed to limit potential losses. A stop loss is your safety net. If the market goes against you, it limits your loss.

The Formula

Here is the formula to calculate the right lot size for your trade:

Lot size = (Account Balance X Risk per Trade) / (Stop Loss in Pips X Pip Value)

OR

Lot size = (Stop Loss in Pips X Pip Value) / (Account Balance X Risk per Trade)

Components

Account Balance: The total amount of money in your trading account.

Risk per Trade: The percentage of your account balance you’re willing to risk (e.g., 1%).

Stop Loss in Pips: The predetermined distance at which your trade will be automatically closed. (In this case; 50)

Pip Value: The monetary value of a single pip movement in the currency pair.

NOTE: The pip value and lot size can vary based on the traded instrument and the account’s base currency.

Demonstration

We have applied this formula to three different currency pairs for demonstration. Now, let’s walk through each example one by one!

Example A

Trading EUR/USD with a $1000 Account.

Account Balance: $1000

Risk per Trade: 1% of $1000 = $10

Stop loss: 50 pips

Pip Value for EUR/USD (assuming 1 lot = 100,000 units and EURUSD = 1.2000): $10 per pip

Calculation: [ 1000 X 0.01 / (50 * 10) ] = 0.02 lots

Explanation:

Consider a trader with a $1000 account balance who decides to risk 1% of their account on a trade. This equates to a risk of $10. The trader sets a stop loss at 50 pips. Assuming that 1 lot in EURUSD is equivalent to 100,000 units and the current exchange rate is 1.2000, each pip’s value is $10. Using the provided formula, the calculated lot size for this trade is 0.02 lots. This means the trader will be trading 0.02 lots of EURUSD to ensure that, with a 50 pips stop loss, they are risking only 1% of their $1000 account.

Example B

Trading XAUUSD with a $5,000 Account.

Account Balance: $5,000

Risk per Trade: 1% of $5,000 = $50

Stop Loss: 50 pips

Pip Value for XAUUSD (assuming 1 lot = 100 units and XAUUSD = $1,800 per ounce): $1 per pip

Calculation [ 5000 X 0.01 / 50 / 1 ] = 1 lot

Explanation:

Imagine a trader with a $5,000 account balance aiming to risk 1% of their capital, which amounts to $50. The trader is dealing with XAUUSD, where 1 lot is equivalent to 100 units, and the current price of XAUUSD is $1,800 per ounce. With a stop loss set at 50 pips and each pip valued at $1, the calculated lot size for this trade is 1 lot. Therefore, the trader will engage in a 1-lot trade of XAUUSD, aligning with their risk management strategy and the specified stop loss.

Example C

Trading SP500 with a $20,000 Account

Account Balance: $20,000

Risk per Trade: 1% of $20,000 = $200

Stop Loss: 50 pips

Pip Value for SP500 (assuming 1 lot = $50 per point): $50 per pip

Calculation [ 20,000 X 0.01 / 50 / 50 ] = 0.08 lots

Explanation:

Consider a trader with a $20,000 account balance deciding to risk 1% of their funds, which equates to $200. This trader trades the SP500, where 1 lot corresponds to a $50 movement per point. Setting a stop loss at 50 pips and with each pip valued at $50, the calculated lot size for this trade is 0.08 lots. This risk management plan implies that the trader will execute a trade of 0.08 lots of SP500, ensuring that with a 50 pips stop loss, they expose only 1% of their $20,000 account to potential loss.

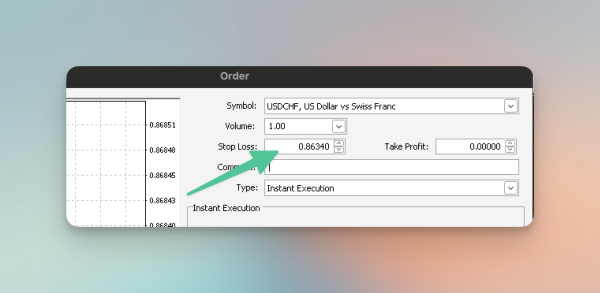

Setting the Stop Loss at 50 pips

Depending on your currency pair, if you want to set a stop loss of 50 pips, you’ll need to calculate the stop loss level based on whether you are entering a buy or a sell position. A “pip” is typically the fourth decimal place for most currency pairs.

NOTE: For pairs involving the Japanese Yen, a pip is the second decimal place.

For a Buy Order

If you enter a buy order at the asking price of 0.8684 and want to set a 50 pips stop loss, you would subtract 50 pips from your entry price.

Calculate 50 pips:

-

50 pips = 0.0050 (since 1 pip = 0.0001 for most pairs)

-

Subtract from your entry price: 0.8684 (entry price) – 0.0050 = 0.8634

-

Your stop loss would be set at 0.8634.

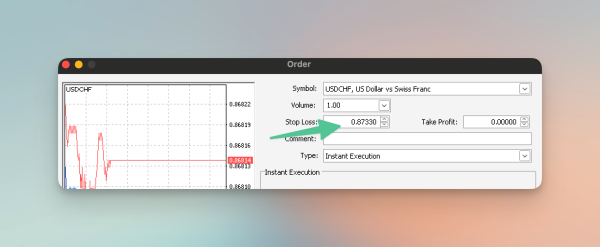

For a Sell Order

If you enter a sell order at the bid price of 0.8683 and want to set a 50 pips stop loss, you would add 50 pips to your entry price.

Calculate 50 pips:

-

50 pips = 0.0050

-

Add to your entry price: 0.8683 (entry price) + 0.0050 = 0.8733.

-

Your stop loss would be set at 0.8733.

The Fastest Way to Calculate Lot Size

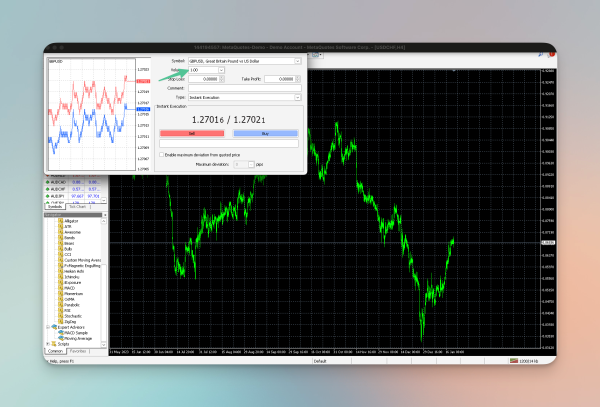

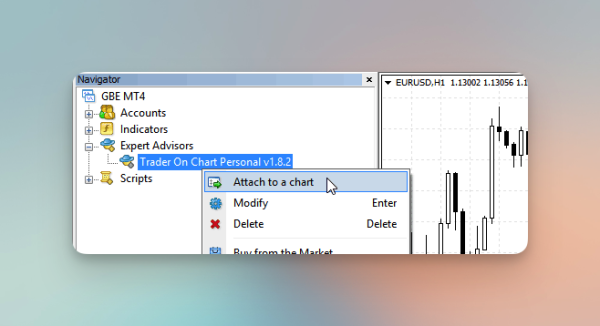

Let me introduce you to the Trader On Chart™ software for MT4. It’s a trade panel and the fastest way to calculate lot size and open a trade on your MT4.

Trader On Chart™ is a Position Size Calculator and MT4 Trade Panel that helps you trade easily from the chart on MT4 Desktop.

With Trader On Chart™, you can open trades 10 times faster in one click because it will calculate lot size automatically based on your preset stop loss and take profit and money management settings.

1. Attach TOC to your MT4 chart

Install and attach the Trader On Chart™ plugin to your MT4 chart. Installation is straightforward and takes less than 5 minutes.

2. Choose your risk per trade (%)

Preset your desired position size, stop loss, take profit, and other trade parameters. You can set the Lot size in percentage (%), money, or fixed lot size.

3. Open a trade in 1-click

Once you preset the settings, you can open a trade or place a pending order with one click.

Check out the Trader On Chart™ yourself here.

Wrapping Up

Effective risk management strategies are a crucial part of forex trading, and choosing the right lot size is one of the ways you can implement risk management in trading. Hence, mastering the lot size formula is paramount for effective risk management in Forex trading. It empowers you to control your risk exposure and protect your account. Additionally, practicing with different currency pairs will enhance your understanding and sharpen your trading skills.

Next Chapter: Spotlighting Top Strategies with MyMT4Book