My Complete Journey: From Strategy Discovery And Backtesting, To Passing.

This tutorial reveals the exact semi-automated process you can follow to successfully pass multiple FTMO challenges — requiring 1 hour of management per week.

🎯 Overview

The process combines FxMagnetic Scanner for strategy discovery (AKA creating and backtesting a strategy) and FxMagnetic Autotrader for hands-free execution. The key here is executions are no longer done manually.

(Keep in mind the terms Scanner and Autotrader because you will see this a lot in this tutorial)

Why This Works

- Easy and fast strategy discovery

- Rapid backtesting on real candle data

- All trade executions are hands-free

- Find strategies that suit your style of trading (scalping, intraday, day trading, or swing)

- Build different strategies for different market conditions

- Requires minimal time investment (1 hour/week)

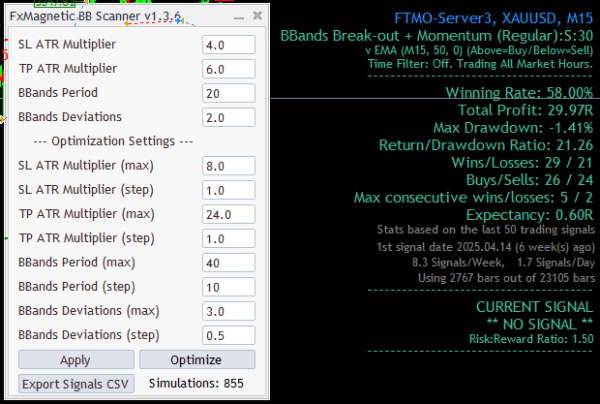

📊 Step 1: Strategy Discovery with FxMagnetic Scanner

The first step is finding a strategy, or strategies, which meet the criteria for prop firm trading.

Key Metrics to Target:

- Expectancy: 0.6 or higher (minimum for challenge viability)

- Return to Drawdown: 10+ (indicates robust performance)

- Max Consecutive Losses: 6 or fewer (manageable risk)

- Risk-to-Reward: 1:2 minimum (essential for profitability)

- Signal Frequency: 3-7 signals per week (optimal for challenges)

With these benchmarks established, here’s how to systematically discover qualifying strategies:

The FxMagnetic Scanner Process:

- Run FxMagnetic Scanner on multiple timeframes (15M, 1H, 4H).

- Filter results based on the key metrics above

- Export promising strategies for deeper analysis

- Use ChatGPT analysis (prompt provided) to validate if the strategy fits the criteria

🤖 Step 2: Semi-Automated Execution Setup

Once a strategy, or strategies, passes the screening, you can run the FxMagnetic Autotrader to automate the strategy.

Risk Management Configuration:

At this stage, you can begin fine-tuning the strategy parameters.

- Risk per Trade: 0.5-1% (adjusted based on strategy’s max drawdown)

- Daily Loss Limit: Set to prevent rule breaches

- Strategy Stop Conditions: Max consecutive losses + 1-2 buffer

Benefits Of Automation In The Semi-Automation:

- No manual trade entry required

- Consistent execution without emotional interference

- 24/7 monitoring and execution

- Automatic risk management application

📈 Step 3: The Real Challenge Journey

Here’s the exact steps with time stamps on how I tested multiple strategies systematically until I found one which passed the FTMO challenge.

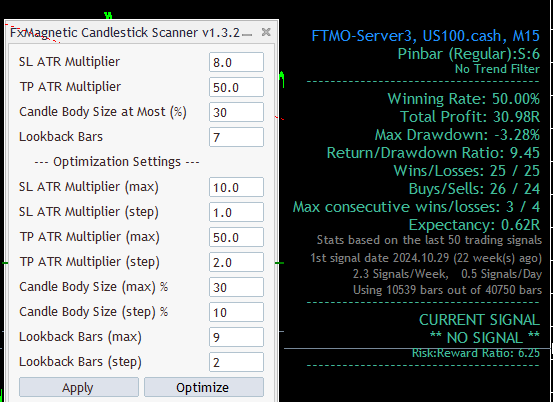

Strategy #1: Pin Bar Strategy (April 11 – May 8)

- Account: $10,000 FTMO Challenge

- Initial Stats: Excellent backtest statistics – 50% win rate, 6.25R risk-reward, 9.45 return/drawdown ratio

- Risk Management: 1.5% per trade

- Outcome: ❌ Passed challenge but disqualified for breaching daily limit by $4

- Key Lesson: Even winning strategies need precise risk management

- Problem: Two trades overlapped same day, creating combined drawdown exceeding daily limits

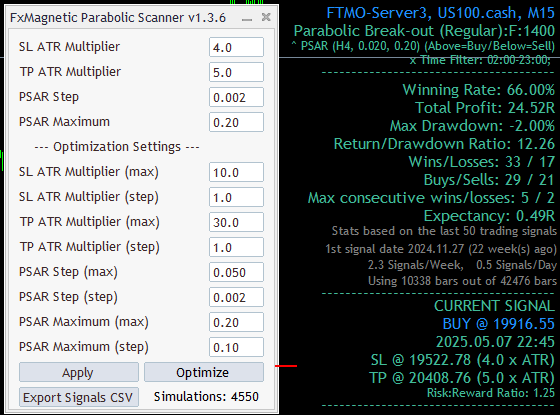

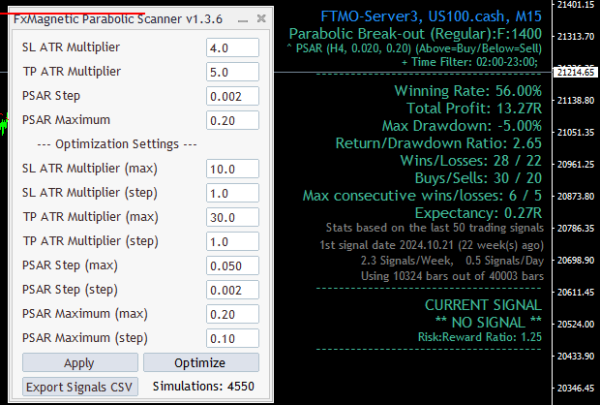

Strategy #2: Parabolic SAR Strategy (May 8 – May 27)

- Account: $25,000 FTMO Challenge (restart)

- Initial Stats: 66% win rate, but low risk-to-reward ratio (1.25R)

- Performance: Account dropped from $25,000 by approximately $700 to $24,300, return to drawdown fell to 2.65

- Outcome: ❌ Strategy stopped due to poor performance

- Duration: Approximately 19 days

- Lesson: Low risk-reward strategies struggle to maintain edge

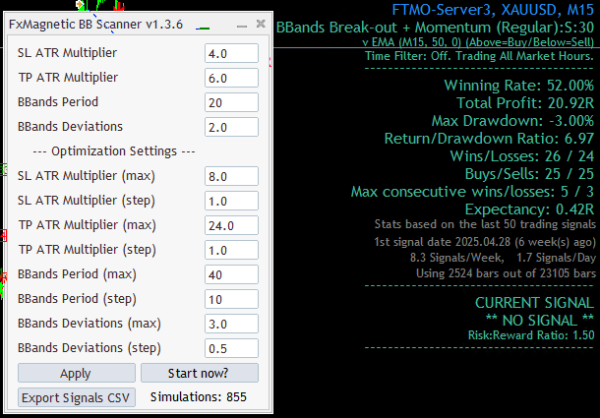

Strategy #3: Bollinger Band Strategy (May 27 – June 4)

- Continuation: Same $25,000 account (starting from $24,829.31)

- Initial Stats: 58% win rate, 1.50 risk-reward ratio

- Performance: 14 trades executed, ended losing -$13.57

- Outcome: ❌ Strategy abandoned – essentially breakeven performance

- Duration: 8 days

- Lesson: Weak expectancy strategies waste time and emotional energy

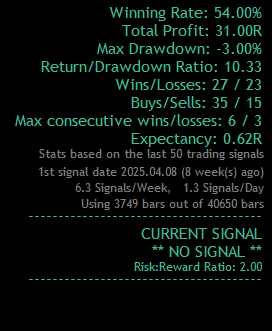

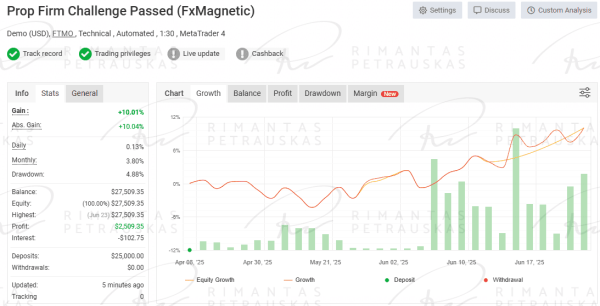

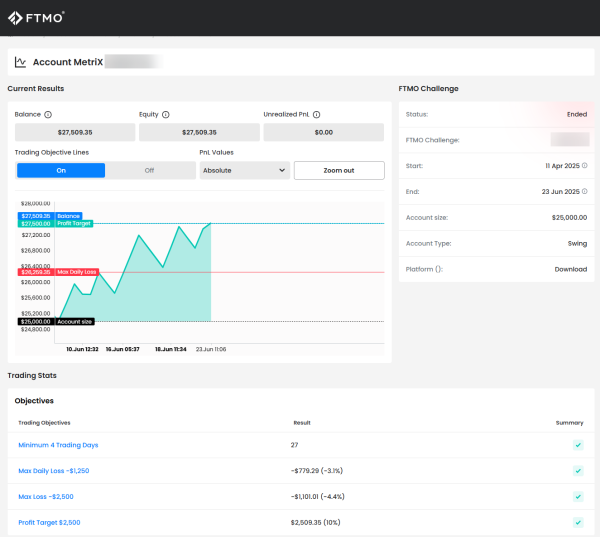

Strategy #4: The Winner (June 4 – June 23)

- Continuation: Same $25,000 account (started from $24,815.74 after previous losses)

- Strategy Type: FxMagnetic Parabolic Scanner-based system

- Final Stats:

- 54% win rate

- Risk-reward ratio: 2.00

- Expectancy: 0.62R

- Max consecutive losses: 3

- Return to drawdown: 10.33

- Trading frequency: 6.3 signals per week

- Outcome: ✅ Successfully passed challenge in 19 calendar days

- Final Balance: $27,509.35

- Key Success Factor: Strategy maintained consistent metrics throughout testing period

Critical Insights from the Journey:

- Persistence Required: Took 4 different strategies over 2+ months

- Risk Precision Matters: $4 breach shows importance of exact calculations

- Expectancy is King: Low expectancy strategies (0.4-0.6) proved insufficient

- Consistency Beats Perfection: Final strategy wasn’t perfect but was reliable

- Documentation Value: Tracking each attempt provided learning insights

⏰ Weekly Management Routine (1 Hour Total)

The beauty of this system is its minimal time requirement. Here’s a sample trading routine you can follow:

Sunday Evening Review (30 minutes):

- Weekly performance summary

- Update risk dashboard

- Prepare for following week’s trading

- Assess upcoming economic data and potential volatility

Mid-Week Check (15 minutes):

- Quick glance at open positions

- Verify auto-trader is functioning correctly

- Monitor for any unusual market conditions

Friday Assessment (15 minutes):

- Check strategy performance metrics

- Compare live results to backtest expectations

- Document any changes in win rate or drawdown

- Plan any strategy rotations if needed

🔄 Strategy Rotation Protocol

The key to success is knowing when to switch strategies:

When to Stop a Strategy:

- Max consecutive losses exceeded (backtest max + 2)

- Return to drawdown drops below 5

- Win rate diverges significantly from backtest

- Strategy shows 3+ weeks of poor performance

Strategy Transition Process:

- Stop current auto-trader

- Run new FxMagnetic Scanner search

- Analyze top 3-5 candidates using ChatGPT

- Select best candidate based on risk profile

- Configure new auto-trader setup

- Resume semi-automated trading

💡 The ChatGPT Analysis Revolution

One of the biggest game-changers was using AI for strategy analysis: We took as screenshot of the result and using a prompt to generate recommendations (improvements, targets, etc.):

The Analysis Prompt Process:

- Take screenshot of strategy statistics

- Input into ChatGPT with custom prompt to assess performance

- Receive detailed analysis including:

- Risk compatibility assessment

- Projected time to reach profit target

- Emotional guardrails and rules

- Strategy improvement suggestions

Sample ChatGPT Insights:

- “Strategy requires 11 trades to reach 10% target”

- “Max consecutive losses of 6 puts daily drawdown at risk”

- “Recommended risk: 0.5% per trade for safer margins”

- “Estimated duration: 7-8 weeks to complete challenge”

🎯 Final Results: The Numbers

Key Success Principles:

- Survival Focus: Risk management keeps you in the game

- Systematic Approach: Remove emotions from decisions

- Patient Execution: Allow your edge to play out over time

- Disciplined Rotation: Know when to switch strategies

Realistic Timeline:

- Learning Phase: 2-4 weeks to understand your system

- Completion: 8-16 weeks total for challenge success

- Time Investment (after learning phase): 1 hour per week average

🚀 Replicating This Success

Required Tools:

- FxMagnetic Scanner (strategy discovery)

- FxMagnetic Autotrader (execution)

- ChatGPT account (analysis)

- Simple spreadsheet (tracking)

Critical Success Mindset:

- Trust the process over individual trade results

- Focus on system execution not prediction

- Maintain discipline during drawdown periods

- Think like a fund manager not a gambler

📝 Final Thoughts

This semi-automated approach transforms any Prop Firm challenge completion from a stressful, time-consuming endeavor into a systematic, time-saving, and manageable process. The key is combining proven technology (FxMagnetic tools) with disciplined risk management and objective decision-making.

Remember: You’re not trying to predict the market—you’re managing a portfolio of systematically-tested strategies with proper risk controls. The semi-automation handles strategy building and executions while you focus on the higher-level management decisions. This semi-automated approach embodies that patience through systematic execution.

“The market is a device for transferring money from the impatient to the patient.”