In this tutorial, we will explore the core trading strategies available in FxMagnetic FVG Trader. Each strategy comes with multiple variations and modes to help traders create strategies that take advantage of market conditions, maximize opportunities, and achieve a better trading portfolio.

This guide is designed to help both new and experienced users to navigate FVG Trader effectively and maximize its features.

What Is The FVG Trader?

FVG Trader strategies use Fair Value Gap identification to find price voids left by sharp impulsive moves and treat those zones as potential areas for price to return to and be “repaired”.

They scan consecutive candles for non-overlapping ranges, record the gap bounds, filter by size or ATR thresholds, and then use retracements into those gap zones as entry areas with stops placed beyond the gap edges and targets set by structure or risk-reward rules.

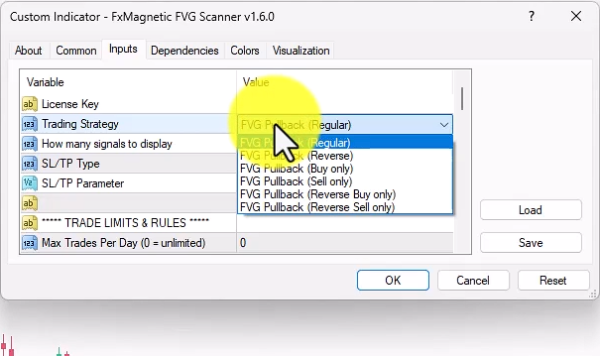

FxMagnetic FVG Trader comes with 2 core trading strategies with several modes:

- Pullback (Regular, Reverse, Buy Only, Sell Only)

- Pullback + Liquidity Sweep (Regular, Reverse, Buy Only, Sell Only)

Before we dive into each, it is crucial to understand the following:

FxMagnetic Universal Parameters

Scanner Application

Every FxMagnetic software has a Scanner which serves as the analytical engine, allowing you to:

- Build and test trading strategies

- Run backtest optimizations

- Generate trading signals based on your configured parameters

- Analyze strategy performance with detailed metrics

On the other hand we have the…

Auto Trader Application

This works in conjunction with the Scanner to:

- Automatically execute signals generated by the Scanner

- Provide hands-free trading once your strategy is configured

- Maintain consistent execution without emotional interference

In short, the scanner does the backtesting then provides trade signals while the autotrader trades those signals. Both of these come with your FxMagnetic purchase.

Strategy Building Blocks

The strategies are your building blocks to develop a trading strategies, and can be further enhanced with:

- Trade filters for additional confirmation

- Time filters for specific trading sessions

- Various exit conditions

- Parameter combinations through optimization (Yes, it comes with an optimization feature)

With FxMagnetic FVG Trader there are virtually endless possibilities for strategy development.

Strategy Trading Modes

Each strategy can be executed in different modes to adapt to various market conditions:

Regular Mode

- Takes both buy and sell trades

- Closes existing trades when opposite signal appears

- Only one trade opens at a time

Reverse Mode

- Takes opposite trades from what the strategy indicates

- Example: Take sell trade when strategy shows buy signal

Buy Only Mode

- Only takes buy trades

- Holds until stop loss or take profit

- Ignores sell signals

Sell Only Mode

- Only takes sell trades

- Holds until stop loss or take profit

- Ignores buy signals

Reverse Buy Only Mode

- Only looks for buy signals but takes sell trades instead

Reverse Sell Only Mode

- Only looks for sell signals but takes buy trades instead

Trade Exit Behavior

- Buy Only/Sell Only modes: Trades exit only at stop loss or take profit

- Regular/Reverse modes: Trades may exit earlier due to opposite signals

Strategy Deep Dive

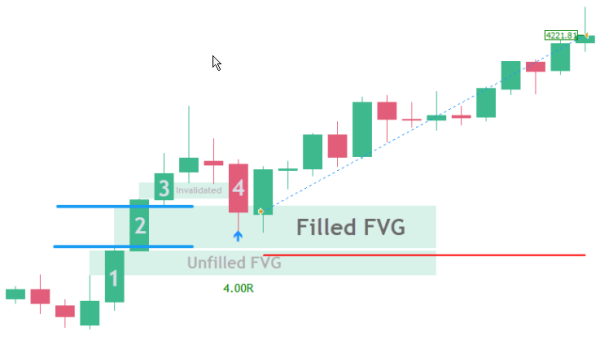

1. Pullback Strategy

A pullback strategy that seeks entries when price returns into a previously formed Fair Value Gap. Variants allow trading with the original FVG direction, reverse entries, and single-side only.

How It Works:

- Identify an FVG created by three candles where the middle candle creates a strong impulse and record its price bounds and age.

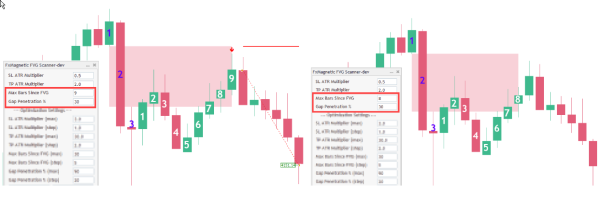

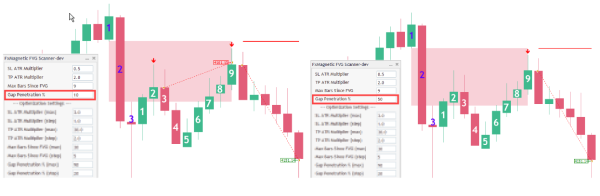

- Wait for price to retrace into the FVG within Max Bars Since FVG and meet the configured Gap Penetration and Pattern Flexibility rules.

Key Parameters:

- Max Bars Since FVG: Maximum bars allowed between FVG formation and a valid pullback entry.

- Gap Penetration %: Required penetration depth into the FVG (0% touch to 100% midpoint/penetration rules).

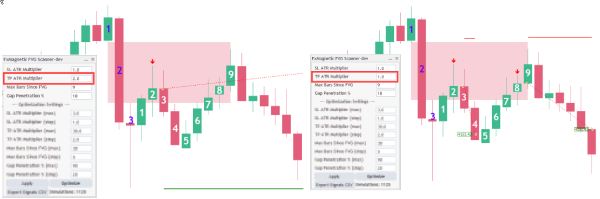

- Pattern Flexibility: Strict or Flexible mode determining whether closes or wicks count for penetration.

- SL/TP System: ATR-based multiples or fixed/Swing High-Low stop and target options.

- Trade Side Variant: Regular, Reverse, Buy Only, or Sell Only selection.

Entry And Exit Logic:

- Buy Signal: Bullish FVG retest meeting penetration, pattern rules, Max Bars Since FVG, and variant direction (or reverse logic if selected).

- Sell Signal: Bearish FVG retest meeting penetration, pattern rules, Max Bars Since FVG, and variant direction (or reverse logic if selected).

- SL/TP Type: ATR-based stops and targets by configurable multiples, with optional fixed or swing high/low alternatives.

Strategy Benefits:

A focused, price-action entry method that captures high-probability retests of imbalance zones. Variant modes and the optional liquidity sweep provide configurable selectivity to reduce false signals and align entries with trader risk tolerance.

2. Pullback + Liquidity Sweep Strategy

A pullback-to-FVG strategy that requires a recent validated liquidity sweep before accepting FVG retest entries, increasing selectivity and timing of pullback trades. Works in Regular, Reverse, Buy Only or Sell Only modes.

How It Works:

- Detect an FVG (fair value gap) from an impulsive move, then wait for a retrace that penetrates the gap per pattern flexibility rules.

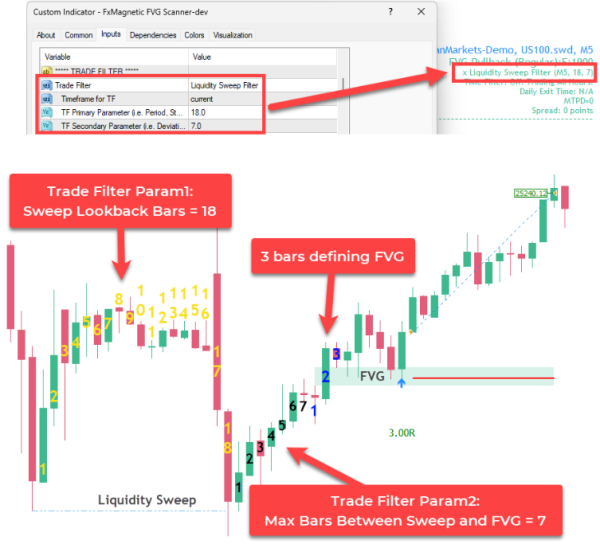

- Independently verify a recent liquidity sweep (on the same timeframe) within a defined lookback, and require the FVG to form or be retested within a proximity window after that sweep.

- Only generate entries when both the sweep validation and the FVG pullback conditions match the chosen variant (Regular/Reverse/Buy Only/Sell Only).

Key Parameters:

- Max Bars Since FVG: maximum bars allowed between FVG formation and a valid pullback entry (typical 5–55).

- Gap Penetration %: Required penetration depth into the FVG

- 0% = any touch qualifies;

- 50% = price must reach at least the midpoint of the gap;

- 100% = in Flexible mode, the wick must fully penetrate the FVG to the opposite boundary (and even beyond), as long as the candle does not close outside the gap.

- Pattern Flexibility: Strict Mode (close must be inside FVG and meet penetration) or Flexible Mode (wicks may touch/penetrate without candle close beyond FVG).

- Sweep Lookback Bars: how many bars to search backward for a validating liquidity sweep (examples: 30, 59, 98).

- Max Bars Between Sweep and FVG: allowed bars between the sweep event and the FVG/pullback for the signal to remain valid (examples: 7, 10).

- Min FVG Size Filter: optional minimum gap size relative to ATR to ignore insignificant gaps.

Entry And Exit Logic:

- Buy Signal: For Regular buy variant, a bullish FVG retrace meets penetration and pattern rules and occurs within Max Bars Since FVG, and a validated liquidity sweep exists within Sweep Lookback Bars and within Max Bars Between Sweep and FVG.

- Sell Signal: For Regular sell variant, a bearish FVG retrace meets penetration and pattern rules and occurs within Max Bars Since FVG, and a validated liquidity sweep exists within Sweep Lookback Bars and within Max Bars Between Sweep and FVG.

- SL/TP Type: ATR-based stops and targets (common: SL 2–6 × ATR, TP 4–30 × ATR) with alternatives for fixed SL/TP or swing high/low stops.

- Trade Filter Used: Liquidity Sweep Filter (same timeframe only) — requires a recent sweep before accepting the FVG pullback.

Strategy Benefits:

Higher-selectivity pullback entries that combine structural imbalance with confirmed orderflow-like liquidity sweeps, reducing false retests and improving timing for higher probability entries.

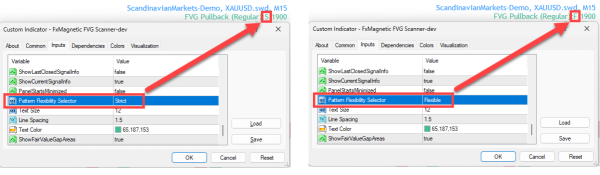

Pattern Flexibility Selector Feature

This feature controls how strictly entry conditions must be met without changing what patterns are detected.

Strict Mode (S)

Pullback candle must close inside the fair value gap (FVG) and the close must meet the required penetration level; wick touches or incidental wick entry do not count as valid penetration.

Flexible Mode (F)

Candle wick or close may touch or penetrate the FVG; the wick is allowed to fully penetrate to the opposite boundary so long as the candle does not close beyond the FVG.

Important Trading Rules

- The software opens one trade at a time per strategy for better risk management.

- For Regular/Reverse modes, new opposite signals close existing trades.

- For “Only” modes, trades run until stop loss or take profit.

- You can use trend filters for additional confirmation.

- Consider reoptimizing the parameters or exploring other modes if experiencing more consecutive losses than historically normal.

Monitoring Performance

Track these key metrics:

- Win rate percentage

- Maximum consecutive losses

- Return to drawdown ratio

- Total profit gained

- Drawdown percentage

Understanding your numbers are crucial to your trading success. Remember, FxMagnetic can only help speed up your strategy development. Your outcomes would still depend on how well you use the software.

Now that you understand the configuration options and how each setting affects signal detection, learn how to implement this in practice. Read our companion guide for the complete workflow—from installation to optimization to live trading.

Tips for Success

- Use optimization scans to test thousands of parameter combinations so you discover settings that work for your specific pair and timeframe rather than relying on default numbers.

- Prefer ATR-based stop-loss/take-profit for most users because ATR adapts to current volatility and reduces the need for per-pair/per-timeframe manual tuning.

- Compare scan results by multiple metrics, total profit | win rate | expectancy | return-to-drawdown, instead of using only one metric; choose the metric that matches your risk profile.

- Monitor ongoing performance and re-optimize periodically to adapt to market regime changes rather than leaving parameters static indefinitely.

- Monitor maximum consecutive losses as an indicator for strategy viability.

- Consider using trend filters or monitor higher time frames to understand the overall trend.

- Regularly optimize settings to adapt to changing market conditions.

- Practice proper risk and money management when using tools like these.