In this tutorial, we will walk you through the process of discovering winning MA trading strategies using FxMagnetic Flow Trader effectively.

You’ll learn essential setup steps, from platform configuration to strategy optimization, and understand how to implement profitable MA-based trading strategies using multiple trading modes and configurations.

This guide breaks down the process into manageable steps: software setup, strategy building using moving average parameters, optimization techniques, and auto trader implementation. We’ll also cover crucial aspects of strategy monitoring and portfolio management to help you stay on track.

We created this to help both new and experienced FxMagnetic users effectively utilize Flow Trader’s features and develop profitable trading strategies.

Initial Setup Checklist

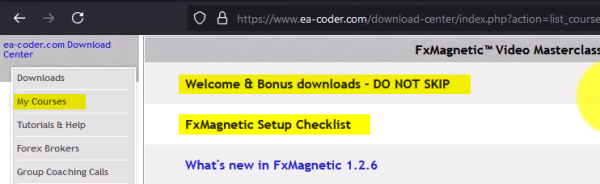

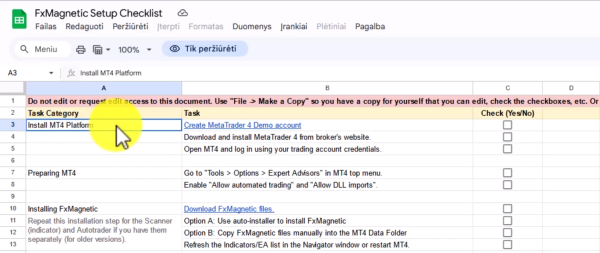

Before beginning any strategy development, access the setup checklist from the download center in your course access section. This document guides the entire setup and optimization process.

To Access Download Center:

- Log into your account

- Click Access Course

- Locate Setup Checklist document

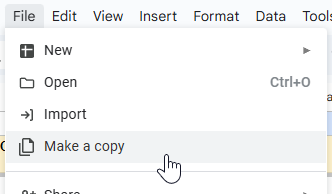

- Upon opening the document, click File > Make A Copy

- Save the copy in your own Google Drive

- Use this checklist as your guide as you progress

Important Note: Don’t skip the welcome and bonus downloads section. All promised bonuses and additional resources are available there.

Downloading And Installing FxMagnetic Software

The installation process for any FxMagnetic Software (i.e: Candlestick, RSI, BB, MACD, Stochastics, etc.) is similar. You can read more about it here.

Preparing Historical Data

Sufficient historical data is essential for accurate backtesting and strategy optimization. Without this, the potential of the software and backtesting results will be limited.

Chart Preparation Steps:

- Open desired trading pair chart

- Select preferred time frame

- Turn off auto scroll

- Press and hold Home button on your keyboard

- Wait for data to load to the earliest available date while holding the Home button

- Once data loading stops (usually after 5 seconds of no movement), release the Home button

- Re-enable auto scroll

Data Requirements:

- Most strategies in general typically need 10,000+ bars while others require 20,000-50,000 bars depending on signal frequency

- Always load as much historical data your broker can provide before running a scan.

Flow Scanner Setup

The Flow Scanner is the analytical engine that processes market data and generates signals based on your configured moving average parameters.

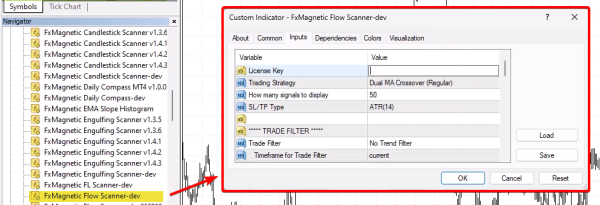

Initial Software Configuration:

- Find Flow Scanner in the Navigator window under Indicators

- Access Navigator via View > Navigator

- Double-click or drag the indicator to your chart

- Input your License Key (found on your download page)

- Initially, start with the Dual MA Crossover Regular strategy

- Configure your trade filters as needed

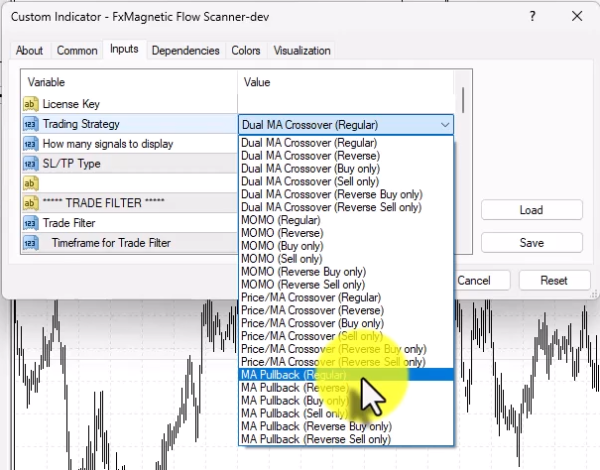

Understanding Flow Trader Strategies

Flow Trader provides multiple sophisticated moving average-based strategies:

Available Trading Strategies

- Dual MA Crossover: Traditional moving average crossover signals

- MOMO (Momentum) Strategy: Created by Kathleen, focuses on momentum reversals

- MA Pullback Strategy: Implements Linda Raschke’s pullback methodology

- Price and MA Crossover: Price crossing moving average signals

Trading Modes

Each strategy can be implemented in different modes:

Regular Mode

- Takes both buy and sell trades

- Closes existing trades when opposite signals appear

- Only one trade opens at a time

Reverse Mode

- Takes opposite trades from strategy signals

- Useful for contrarian approaches

Buy/Sell Only Modes

- Trades only in one direction

- Holds until stop loss or take profit

Building Your Trading Strategies

Flow Trader offers extensive customization options. Here are example configurations for different strategies:

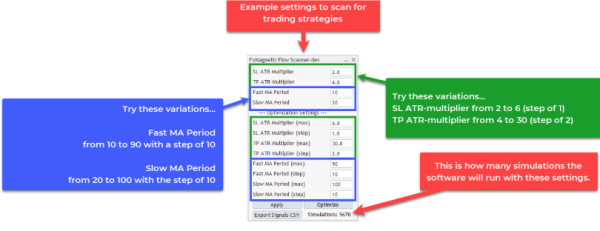

Dual MA Crossover Strategy Example

Basic Setup:

- Trading Strategy: Dual MA Crossover Regular

- Trade Filter: EMA 50 (current timeframe)

- Stop Loss Type: ATR 14

- Pattern Flexibility: Strict (S)

- Spread: 10 points

Parameter Ranges for Optimization:

- Stop Loss (ATR multiplier): 2 to 6, step of 1

- Take Profit (ATR multiplier): 4 to 30, step of 2

- Fast MA Period: 10 to 90, step of 10

- Slow MA Period: 20 to 100, step of 10

MOMO Strategy Example

Setup Configuration:

- Trading Strategy: MOMO Regular

- Trade Filter: As needed for trend confirmation

- ATR Period: 14

- Pattern Flexibility: Strict

Key Parameters:

- Focus on momentum reversals using EMA crossovers

- Combines price action with momentum indicators

- Suitable for trending market conditions

MA Pullback Strategy Example

Configuration:

- Trading Strategy: MA Pullback Regular

- Trade Filter: ADX 14 with threshold of 20

- Lookback Bars: 15

- MA Period: 80

Strategy Logic:

- Price must pullback to the moving average

- Pullback must occur within specified lookback period

- ADX filter ensures trending conditions

- Implements Linda Raschke’s methodology

You can see more sample settings in this cheat sheet.

It’s important to understand that this is just the initial step and you are most likely to find better settings that are more profitable after you optimize.

Keep in mind: Higher timeframes = Less signals but reliable. Lower timeframe = More signals but less reliable. The key is finding a timeframe that fits your trading style and gives you winning results.

Optimizing Your Strategy

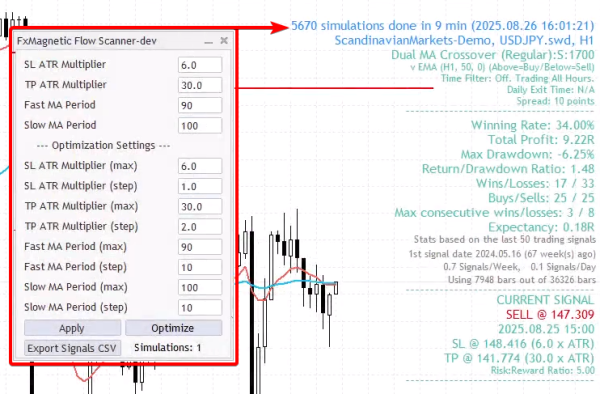

The software will test different values within the parameter range to find one with the best result. Approximately, it will run 3,000 simulations depending on your settings, and takes around 10 to 30 minutes depending on your computer.

Optimization Preparation:

- Performance Setup: Close unnecessary charts and programs to improve processing speed

- Duration: Expect 10-30 minutes depending on computer performance

- Simulation Count: Approximately 3,000+ combinations tested

- Filter Settings: Configure optimization filters to focus on viable strategies

Setting Optimization Filters:

Before optimization, configure these important filters:

- Risk Reward Ratio: Minimum 2, Maximum 5

- Return to Drawdown: Minimum 10

- Max Consecutive Losses: Maximum 3

- Minimum Signals: 50

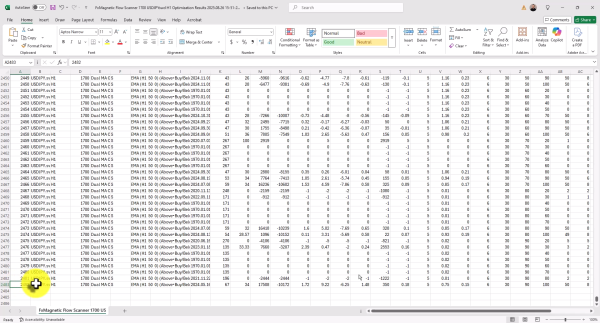

Reviewing The Results (Important!)

The values seen on your chart after the optimization provides an overview of how the strategy’s parameters performed. This alone could help you decide how you will move forward.

- Navigate to File > Open Data Folder > MQL4 > Files

- Open FX Magnetic Flow Scanner Optimization Results folder

- Open the most recent CSV file

- Use filtering to analyze results:

- Filter by Signal Count (minimum 50)

- Sort by Return to Drawdown Ratio

- Review top strategies for viability

Key Metrics to Evaluate:

- Win rate (aim for 45%+ with risk/reward of 2+)

- Total profit and time period

- Maximum drawdown

- Return to drawdown ratio

- Trade frequency

- Maximum consecutive losses

Applying Strategy Templates

Using CSV Results:

- This is where the magic starts. You can get this via the Export Signals CSV

- Identify the strategy parameters from your optimization results

- Note: Symbol, timeframe, strategy type, trade filters

- Configure Flow Scanner with exact parameters:

- Stop loss and take profit multipliers

- Moving average periods

- Trade filter settings

- Spread configuration

Parameter Application:

- Ensure all settings match exactly: pair, timeframe, strategy mode

- Include spread settings for realistic results

- Verify trade filter parameters and timeframes match

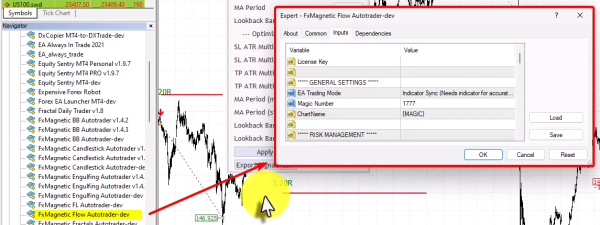

Auto Trader Configuration

Once you’ve identified a profitable strategy, implement automation using the Flow Auto Trader.

Basic Setup:

- Locate Flow Auto Trader in Expert Advisors under Navigator

- Drag to the same chart where your Flow Scanner is attached

- Input your License Key

- Select Indicator Sync Mode (recommended default)

- Set unique Magic Number for strategy identification

Risk Management Settings:

- Money Management Mode: Choose Risk Per Trade (%)

- Risk Per Trade: 0.25% – 1% recommended

- Position Sizing: Software calculates lot size automatically

- Consecutive Loss Buffer: Consider using lower risk if allowing more consecutive losses than backtested

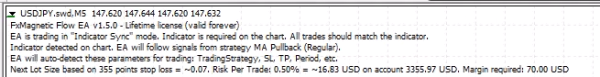

Verifying The Setup:

After confirming the setup (click OK), the auto-trader will print information on the top left corner of the chart. Note that the autotrader won’t work during the weekend. However, this will auto activate as soon as the market opens.

Strategy Monitoring

Effective monitoring ensures strategy performance remains within expected parameters.

Performance Metrics to Track:

- Consecutive Wins/Losses: Monitor against backtest expectations

- Win Rate Percentage: Should align with optimization results

- Profit/Loss Ratios: Track actual vs. expected performance

- Drawdown Levels: Ensure they remain within acceptable limits

- Trade Frequency: Verify signal generation matches backtest

Strategy Validation Guidelines:

- Minimum Sample Size: Allow 20-30 trades for statistical significance

- Warning Signals: Monitor for consecutive losses exceeding backtest maximum by 1-2 trades

- Performance Tracking: Track each strategy separately

- Expectation Management: Compare live results against backtest projections

When to Re-evaluate:

- Consecutive losses exceed backtest maximum by 2+ trades

- Win rate drops significantly below backtest expectations

- Drawdown exceeds historical levels substantially

- Market conditions change dramatically

Strategy Portfolio Management

Building a robust trading portfolio requires careful strategy selection and ongoing management.

Portfolio Development Approach:

- Start Small: Begin with 2-3 well-tested strategies

- Gradual Expansion: Add new strategies after proving existing ones

- Diversification Strategy:

- Multiple currency pairs

- Different timeframes

- Various moving average approaches

- Different market conditions (trending vs. ranging)

Strategy Evaluation Process:

- Performance Review: Regular assessment of each strategy’s metrics

- Lifecycle Management: Remove underperforming strategies, keep successful ones

- Documentation: Maintain detailed records of each strategy’s performance

- Optimization Schedule: Regular re-optimization to adapt to changing market conditions

Risk Distribution:

- Never allocate more than 1% risk per strategy initially

- Consider reducing risk per trade if running multiple strategies

- Account for correlation between strategies on same or related pairs

Advanced Strategy Management

Strategy Rotation Approach:

Rather than seeking one permanent strategy, adopt a dynamic approach:

- Strategies work for weeks to months, not indefinitely

- Market conditions change, requiring strategy adaptation

- Maintain 3-5 active strategies across different pairs/timeframes

- Replace strategies when they exceed consecutive loss limits

Performance Expectations:

- Challenge Timeframes: Expect 1-2 months for typical prop firm challenges

- Skill Development: Strategy management improves with experience

- Realistic Goals: Focus on consistent performance over quick profits

- Continuous Learning: Markets evolve, requiring ongoing adaptation

Tips For Success

- Timeframe Quality: Higher timeframes generally produce fewer but higher-quality trades. Focus on quality over quantity.

- Patience is Essential: Some strategies may require 5+ days before generating their first winning trade. Avoid overtrading due to impatience.

- Strategy Longevity: Don’t immediately abandon strategies when market behavior changes. Allow for normal market cycles.

- Risk-Reward Balance: High risk-reward strategies typically have longer losing streaks, while lower risk-reward strategies have shorter streaks. Find your optimal balance.

- Individual Strategy Tracking: Never judge multiple strategies by overall account balance. A profitable strategy might be hidden by a losing one.

- Portfolio Approach: Think of strategies like an investment portfolio. When one underperforms, others may compensate.

- Realistic Expectations: No 100% win rate strategy exists. Avoid over-optimization and focus on consistently profitable systems.

- Process Over Profits: Focus on following your systematic approach rather than chasing quick gains.

- Skill Development: Treat trading as a skill that improves over time, not a get-rich-quick scheme.

- Mindset Management: Understand that successful trading requires patience, discipline, and continuous learning. Avoid chasing “magical” solutions that promise effortless profits.