In this tutorial, we will explore how to effectively use the FxMagnetic Hull Shield indicator to identify and avoid choppy market conditions. You’ll learn how this enhanced version of the traditional Hull Moving Average can help you filter out low-quality trading conditions and focus only on clean trends.

What is Hull Shield?

Hull Shield is an enhanced version of the traditional Hull Moving Average specifically designed to act as a smart trade filter. Unlike typical moving averages, Hull Shield doesn’t just smooth price and reduce lag – it goes further by:

Detecting choppy, low-quality market conditions

Detecting choppy, low-quality market conditions

- Filtering out periods of market indecision

- Helping you trade only during clean trends

- Using a specialized algorithm to identify trend deterioration

The indicator isn’t primarily designed for picking entry points but rather serves as a powerful trend filter to improve your trading decisions.

How Hull Shield Works

The Hull Shield uses a specialized algorithm that analyzes market conditions to determine whether a trend is strong, fading, or non-existent. Here’s how it works:

- Green Line: Indicates an uptrend – look for buy opportunities

- Purple Line: Indicates a downtrend – look for sell opportunities

- Empty Spaces: Indicates choppy markets – avoid trading

The indicator’s specialized algorithm examines multiple factors to determine market conditions…

What Hull Shield Analyzes to Detect Choppy Markets

- Lack of higher highs/lower lows—Price not progressing in one direction

- Flat or zigzagging Hull slope—Frequent direction changes

- The majority of the last 5 candles are not aligned—e.g., a mix of bullish and bearish

- Short-distance swings—Price moving in tight, indecisive ranges

- Too many trend flips in a short time—Signals false moves

- Insufficient trend momentum—Trend not “committed” enough for entry

The Runner Analogy

To better understand how Hull Shield detects trends and the end of it, imagine a trend as a runner on a track:

- A strong trend resembles a runner moving at a consistent, fast pace in one direction

- When the trend begins to fade, it’s like watching the runner slow down

- Sometimes the runner stops completely, then walks for a bit, then tries to run again, then walks—showing inconsistent or erratic momentum.

- Other times, the runner might suddenly change direction.

The software observes and identifies these “runner behaviors” and draws out lines to signal if the market is in a trend, and draws nothing if its not.

But just as you can’t predict what will the runner do next, Hull Shield doesn’t attempt to forecast future price movement. It can only react and show you what the runner is currently doing.

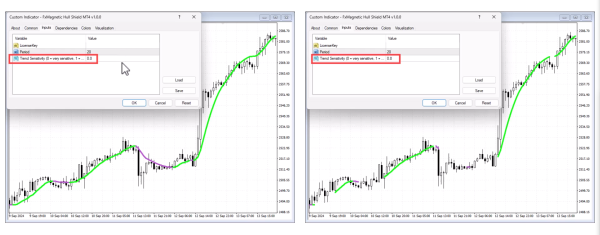

Hull Shield Configuration

The indicator has three main parameters:

- License Key: Your unique license key is received after purchase

- Period: How many bars to look back for calculating the Hull Moving Average (default: 100)

- Trend Sensitivity: Controls how strictly the indicator filters choppy conditions

- 0 = Least sensitive (behaves like traditional Hull Moving Average)

- 1 = Most sensitive (strictly filters out all but the strongest trends)

- Recommended setting: 0.7-0.8

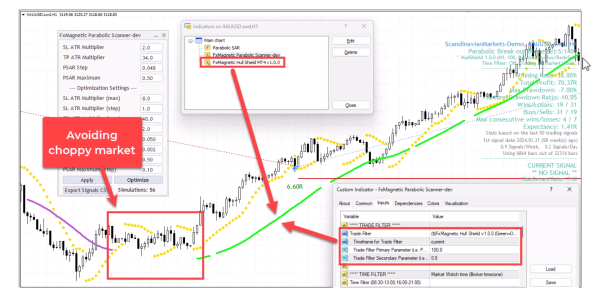

Using Hull Shield as a Trade Filter

Hull Shield can be applied as a trade filter in any FxMagnetic scanner. Here’s how to set it up:

- Open your preferred scanner (Parabolic, MACD, RSI, Candlestick, etc.)

- Go to Scanner Options

- Navigate to Indicator List

- Select your scanner and click Edit

- In the Inputs tab, locate the Trade Filter section

- Enable Trade Filter and select “Hull Shield ($)” from the dropdown

- Configure the following parameters:

- Timeframe: Select “Current” to apply the filter on the current timeframe, or choose a higher timeframe

- Primary Parameter: Set the period (recommended: 100)

- Secondary Parameter: Set the trend sensitivity (recommended: 0.7-0.8)

- Click OK to apply the filter

Visualization (Optional)

Although the scanner can access Hull Shield from memory without displaying it on the chart, you may want to visualize it for confirmation:

- Locate Hull Shield in the Navigator panel under Indicators

- Double-click or drag it to your chart

- Enter your license key

- Set the Period to match your trade filter setting (e.g., 100)

- Set the Trend Sensitivity to match your trade filter setting (e.g., 0.8)

- Click OK to display the indicator

Trading with Hull Shield

When using Hull Shield as a trade filter, your scanner will only generate signals under these conditions:

- Buy Signals: Only when Hull Shield shows a green line (uptrend)

- Sell Signals: Only when Hull Shield shows a purple line (downtrend)

- No Signals: When Hull Shield shows an empty space (choppy market)

This three-state approach differentiates Hull Shield from traditional two-state filters, as it explicitly identifies periods to avoid trading completely.

Sensitivity Adjustment Guidelines

Finding the right sensitivity setting is crucial for optimal performance:

- Low Sensitivity (0-0.3): Behaves similar to traditional Hull Moving Average, may generate false signals

- Medium Sensitivity (0.4-0.6): Balanced filtering, default starting point

- High Sensitivity (0.7-0.8): Recommended for most trading strategies, filters most choppy conditions

- Maximum Sensitivity (0.9-1.0): Very strict filtering, may miss some good trades but highest quality signals

Availability

As of this tutorial’s creation, Hull Shield is available as a trade filter for:

- Parabolic Scanner

- (Coming soon to other FxMagnetic products)

If you’ve purchased Hull Shield, you’ll be able to use it with any compatible FxMagnetic scanner once it’s added to that product.

Tips for Success

- Match Settings: Ensure the Hull Shield period and sensitivity settings match between the trade filter and the visual indicator (if used)

- Higher Timeframes: Consider using Hull Shield on higher timeframes for more reliable trend identification

- Patience: The indicator won’t forecast trends but reacts to current market conditions

- Experiment: Test different sensitivity settings to find what works best for your trading style and instruments

- Complement: Combine Hull Shield with your existing strategy rather than using it as a standalone entry system

- Track Performance: Compare your results with and without Hull Shield to validate its effectiveness

Conclusion

Hull Shield offers a powerful way to avoid trading during choppy, low-quality market conditions. By filtering out periods of market indecision, it helps you focus only on high-probability trading opportunities during clean trends. While no indicator can predict market direction with certainty, Hull Shield provides valuable insight into the current market state, helping you make more informed trading decisions.

Remember that Hull Shield is designed to be used as a filter, not as a primary entry signal generator. Combine it with your preferred entry strategy for optimal results.